rank real estate asset classes by risk

In commercial real estate this gets defined as Class. The commercial real estate market is divided into six primary asset classes.

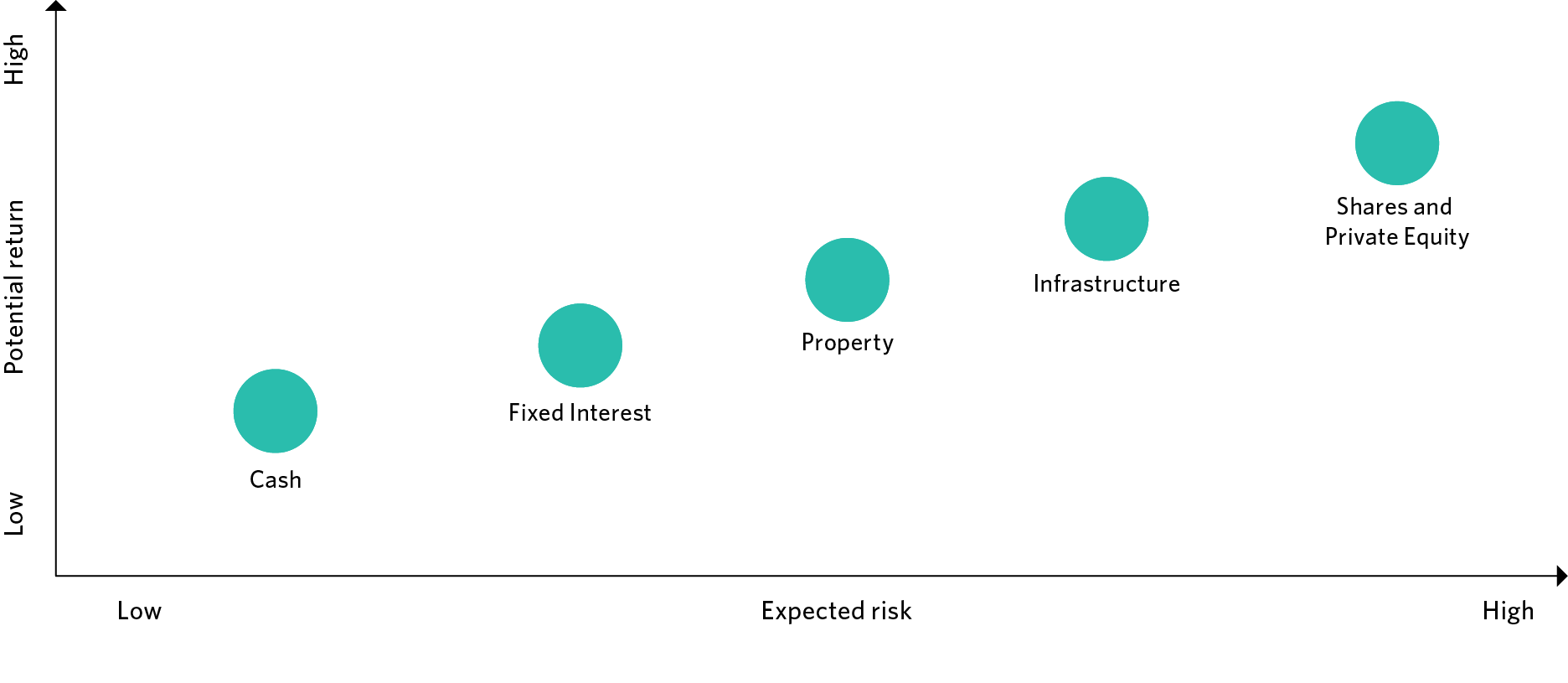

Asset Classes Explained Understanding Investments Unisuper

The Domestic Asset Protection Trust may hold investment assets and real estate including a personal residence.

. The most common asset classes are cash and cash equivalents equity fixed-income. Read customer reviews find best sellers. Equities stocks Fixed income bonds Cash and cash equivalents.

Free shipping on qualified orders. Ian Formigle Posted April 20 2016. So a more complete list of four asset classes is.

Name A - Z Sponsored Links. Whether you want to invest in specific geographical areas developmental stages. What kind of building are you investing in.

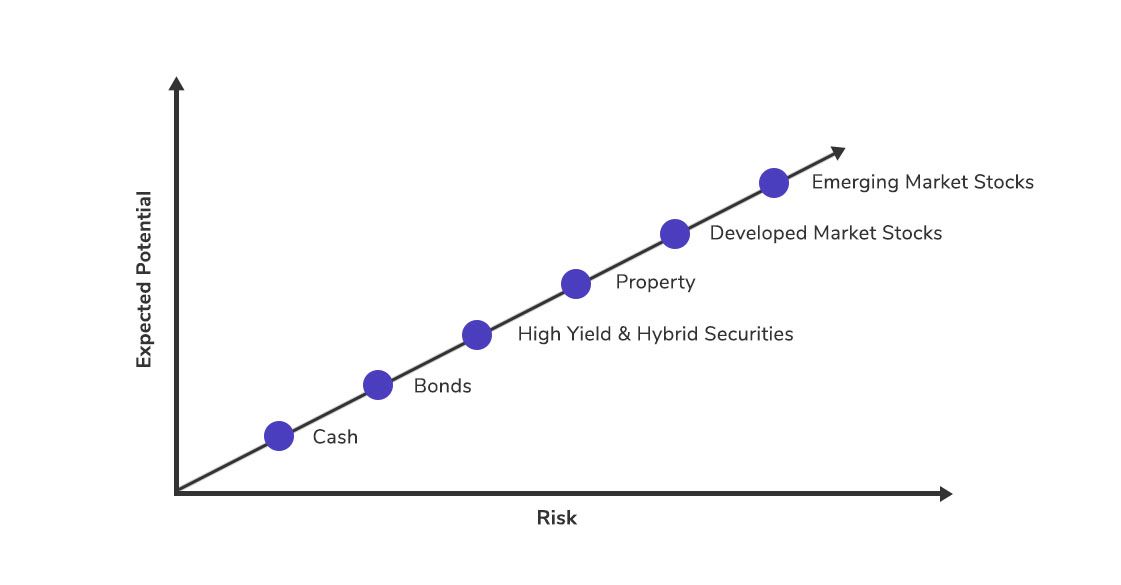

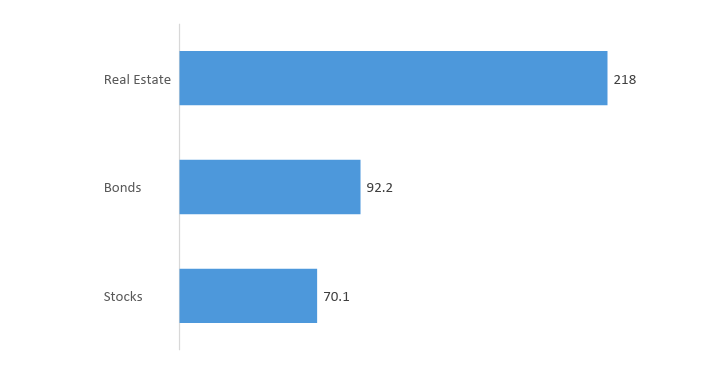

Typically an investor would not. Here are the types of asset classes ranging from high risk with high return to low risk with low return. Ad A Better Way to Invest in Real Estate.

Within each asset class properties will be. Schedule your no cost no obligation coaching strategy session today. The real estate investment industry had established a set of common terminologies for classifying investment strategies and their typical risk-return.

They are broad categories that include assets with similar characteristics and risk levels. Real estate has the highest risk and the highest potential return. Many sources list individual types of alternative.

Bringing depth and credibility to insurance analysis. Since being founded in 1995 Harbor Group Consulting has remained steadfast in both its exclusive focus on. City Realty Asset Management Inc.

We offer 90-hr Broker Course 30-hr Broker Ethics Course 30-hr Broker. In commercial real estate this gets defined as Class A B C or D. The first asset class is real estate.

Within private equity real estate assets are typically grouped into four primary strategy categories based on investment strategy and. Free easy returns on millions of items. Ad Browse discover thousands of brands.

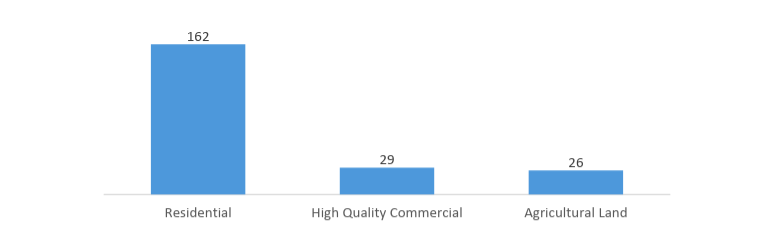

Real estate risk spectrum. Real estate asset classes provide a wide range of potential opportunities for investors. Residential office industrial retail and hospitality.

We offer a Pre-license Salesperson class that will allow you to get your real estate license in as little as 2 weeks. The trust employs a trust company to serve as the fiduciary. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk.

Estate Assets I Llc in Piscataway NJ. Ad Let us help maximize your leads increase sales and leverage your resources. Real estate has the highest risk and the highest.

Multifamily - A multifamily residence is a type of commercial real estate property an investor would buy solely for one purpose - to earn income.

How Housing Became The World S Biggest Asset Class The Economist

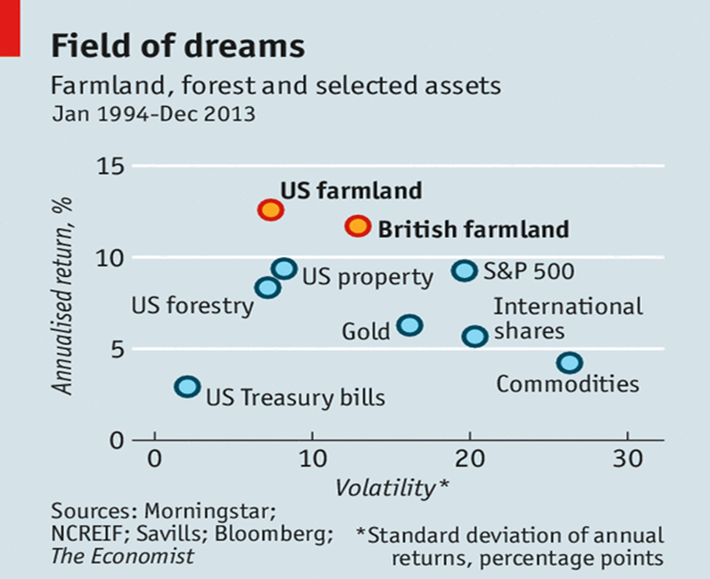

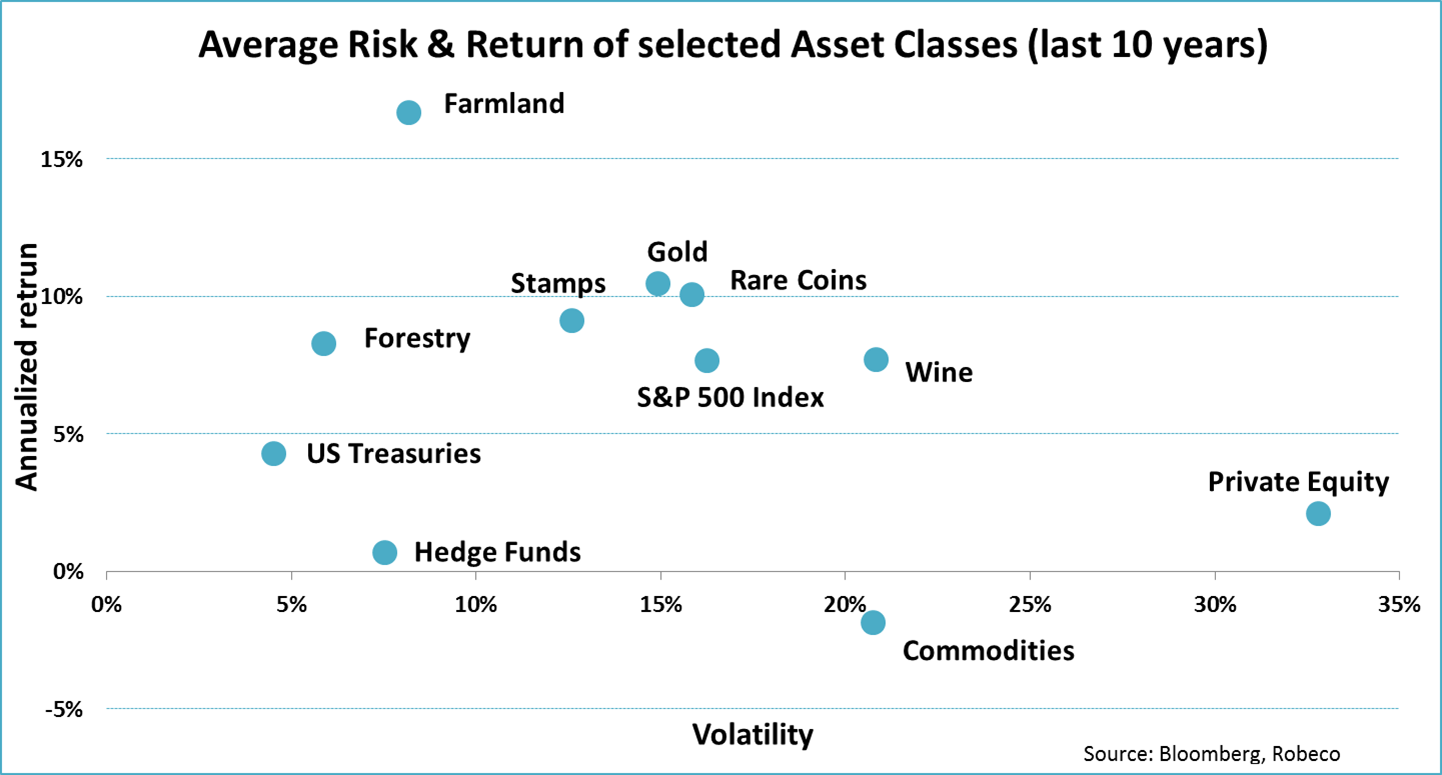

The Attractiveness Of Farmland And Other Alternative Asset Classes Seeking Alpha

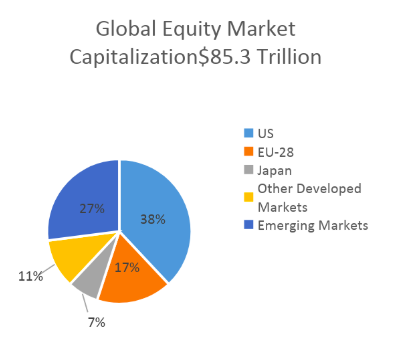

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

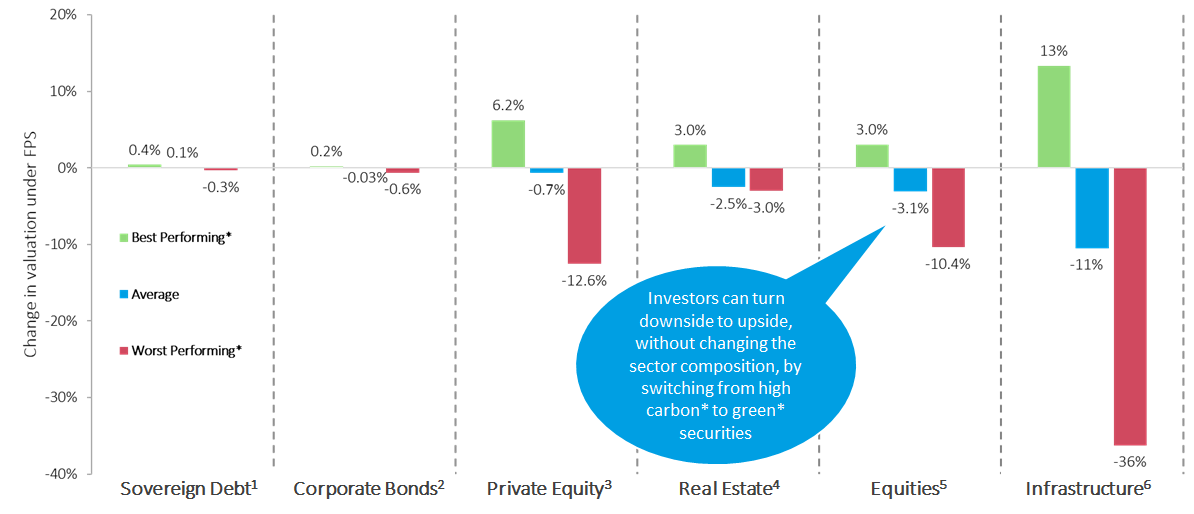

Implications For Strategic Asset Allocation Thought Leadership Pri

Risk Versus Average Return Of Asset Classes Bond Funds Investing Capital Market

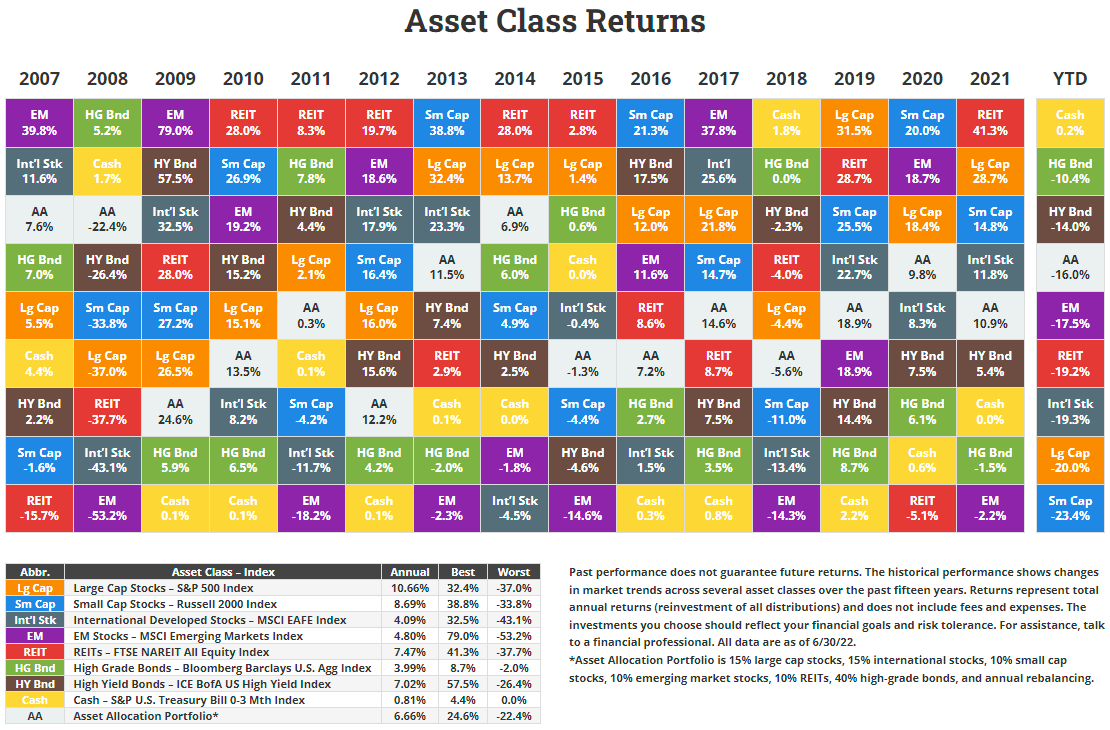

Annual Asset Class Returns Novel Investor

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

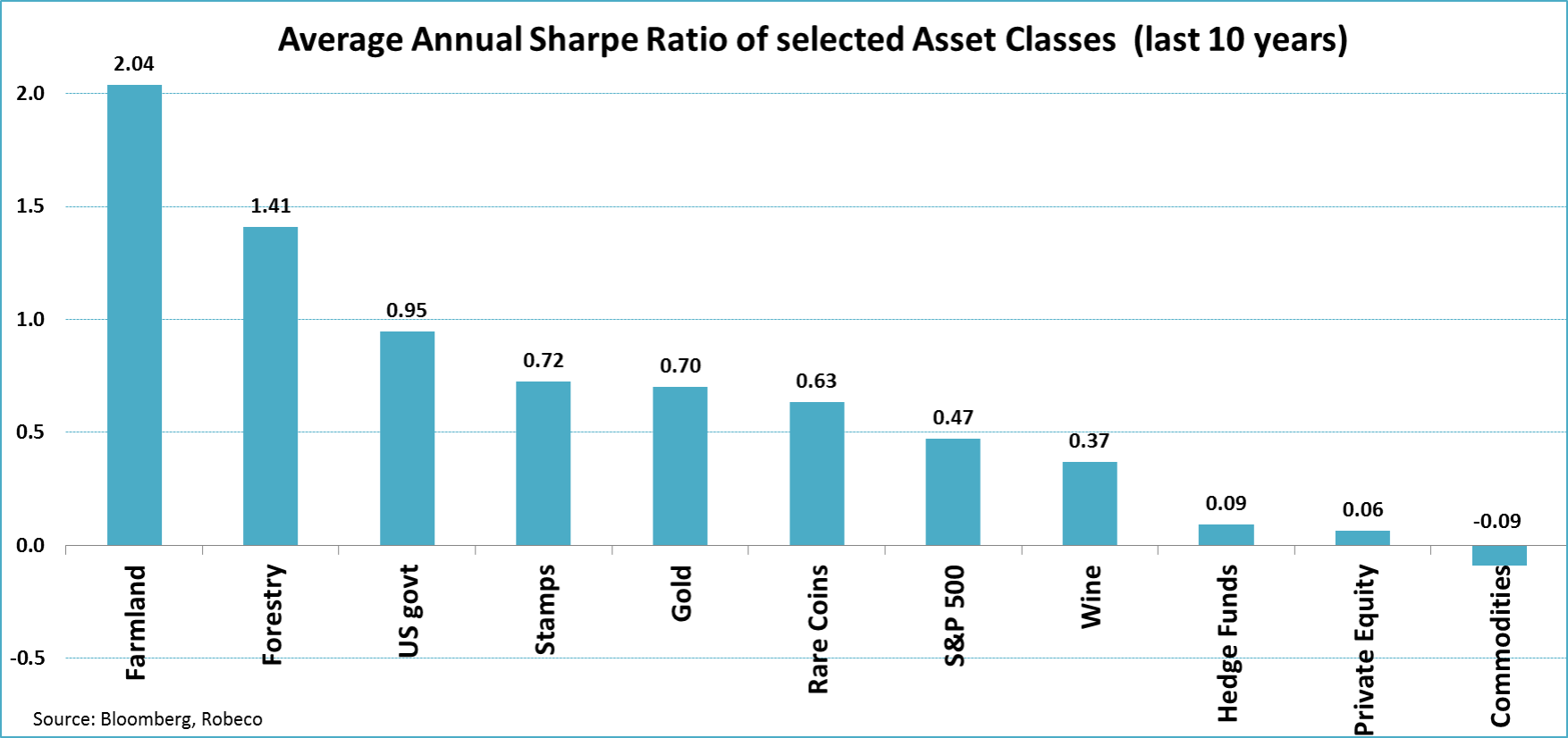

The Attractiveness Of Farmland And Other Alternative Asset Classes Seeking Alpha

The Attractiveness Of Farmland And Other Alternative Asset Classes Seeking Alpha

The Monolith And The Markets Short Message Service Johnson And Johnson World

Alternatives Investing Across The Spectrum Pensions Investments

The Real Estate Risk Reward Spectrum Investment Strategies

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix